In the realm of corporate relocation, home sale assistance programs play a crucial role in easing the transition for employees and companies alike.

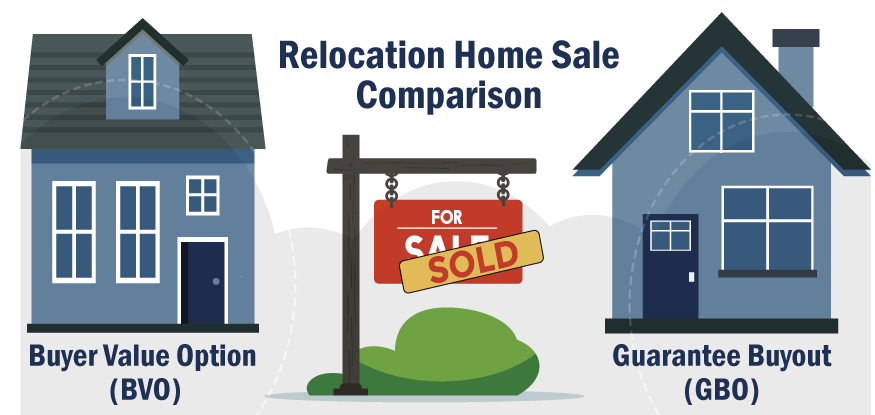

Among the relocation home sale programs, the most popular options are the Buyer Value Option (BVO) and the Guaranteed Buyout Option (GBO) programs.

Each option offering distinct advantages tailored to different needs, our blog will review:

- Buyer Value Option (BVO) features and benefits

- Guaranteed Buyout (BVO) features and benefits

- Provide a side-by-side comparison of the home sale programs

Buyer Value Option

(BVO)

In a Buyer Value Option program (BVO), the employee is responsible for listing their home for sale, with marketing assistance from the Relocation Management Company (RMC). The employee must secure an outside buyer willing to purchase the home at a fair market value. A buyer value option program provides all the tax benefits to the employer and employee, but it depends on the employee securing an outside buyer. The employee is funded their equity, if the contract is deemed valid, based on the outside offer amount. The RMC closes the sale with the buyer at a future date. In a BVO home sale scenario, home appraisals are never ordered.

Buyer value options are a good way for an employee to oversee the entire process and ensure the best fit for their home. The risk of the home sale falling through falls onto the employee in this home sale option.

Guaranteed Buyout Option

(GBO)

What is a Guaranteed Buyout (GBO) program and how does it differ from a Buyer Value Option (BVO)?

Under a GBO program, the RMC orders two home appraisals and then averages the two to determine a guaranteed offer, with a fixed acceptance period. If the employee cannot sell their home on their own, the employer takes the home into inventory. The employer must maintain it until the company can resell it. This carries potential risks and additional costs for an employer.

A BVO home sale, on the other hand, minimizes this risk since the employer only purchases the home after the employee has secured an outside buyer. BVO and GBO home sale programs provide tax benefits to the employer and employee.

BVO Home Sale versus GBO Home Sale

When comparing the two, the choice between BVO and GBO depends largely on the company’s risk tolerance, market conditions, and the level of support they wish to provide to their employees.

BVO programs are cost-effective for companies but can place additional burdens on employees, making them more suitable for strong housing markets.

Conversely, GBO programs, while more expensive, offer greater assurance to employees, making them a preferred choice in uncertain markets or when a company prioritizes employee satisfaction and seamless relocations.

Here’s a side-by-side comparison of Buyer Value Option (BVO) and Guaranteed Buyout Option (GBO) home sale programs

Our countless years of BVO and GBO Home Sales experience can help you better navigate your journey.

This can include the range of tax implications, relocation variables, benefit payouts/amounts, and marketing work.

Let the experts at WHR Global help you with your BVO or GBO home sale relocation

and other global mobility program needs

- Direct Reimbursement

- Home Inspections

- Home Sale Bonuses

- Loss on Sale

- Rental Assistance/Lease Break Assistance

- Destination Services (temporary housing; house hunting trip; destination closing costs; renter destination services)

- Household Goods Moves (plus vehicle shipment and temporary storage)

- Lump Sum Benefits – view Lump Sum breakdown vs. Managed Budget

- Cost of Living Assistance (COLA)

- Policy Exceptions

- Policy Tiers vs Core Flex Benefits

U.S. Domestic Relocation Cost Estimator

Interactive Repayment Agreement

Domestic Relocation Policy Designer

Relocation Benchmark Comparison

RFP – Relocation Request for Proposal Generator